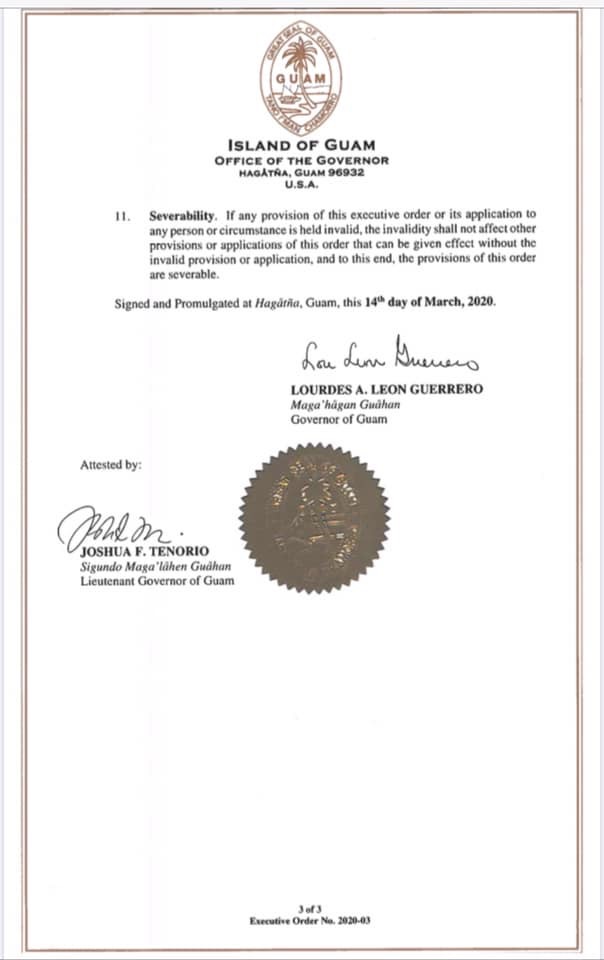

Emergency Declaration: COVID-19 on 3/14/2020

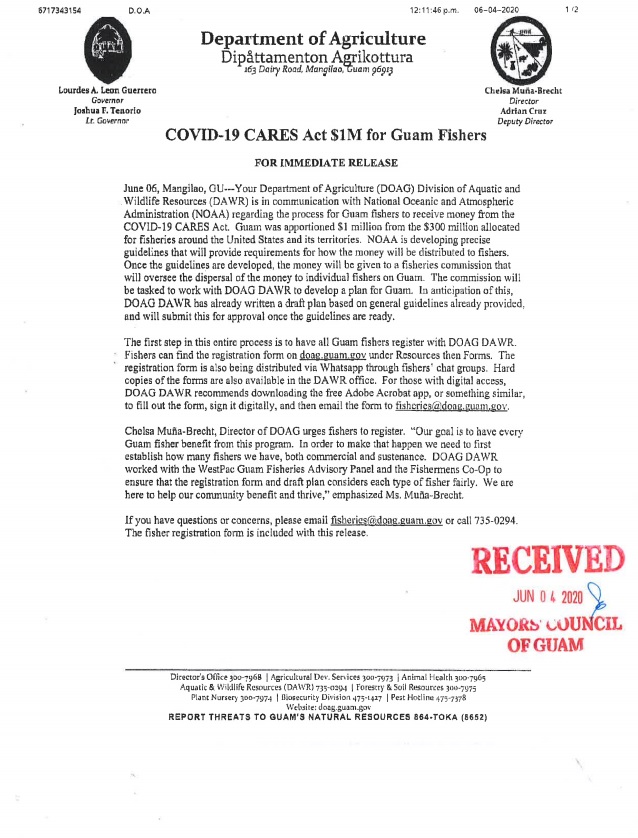

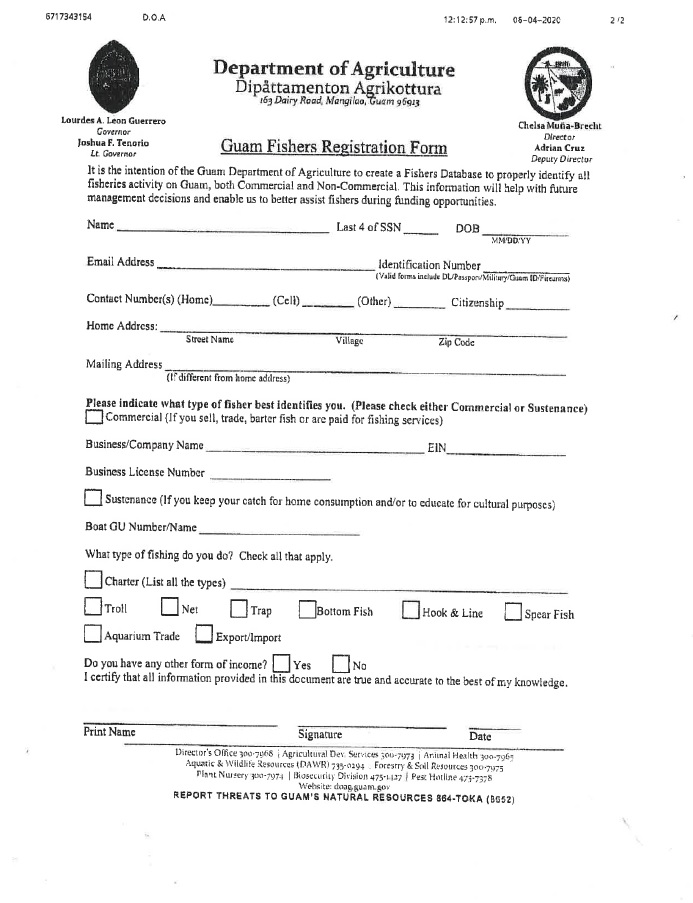

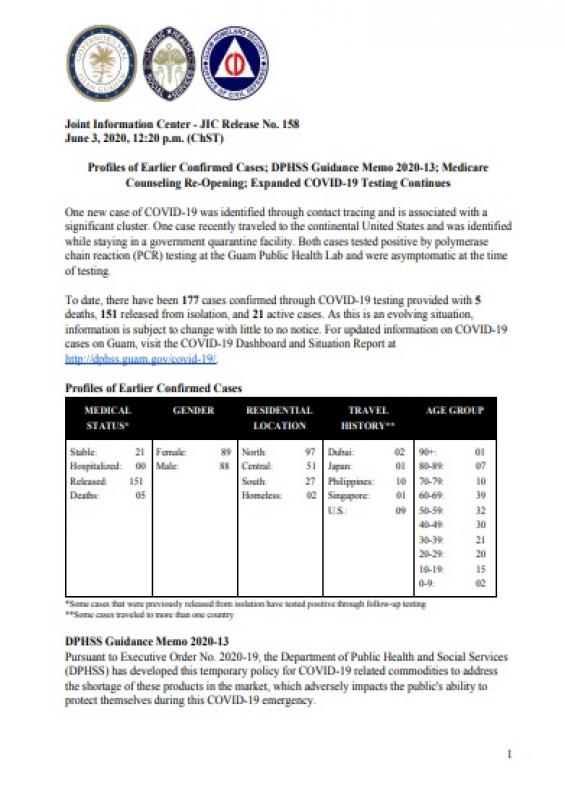

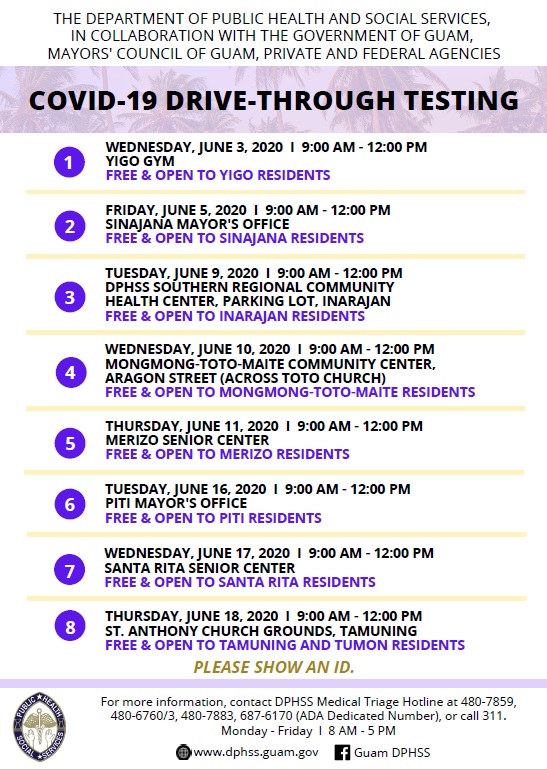

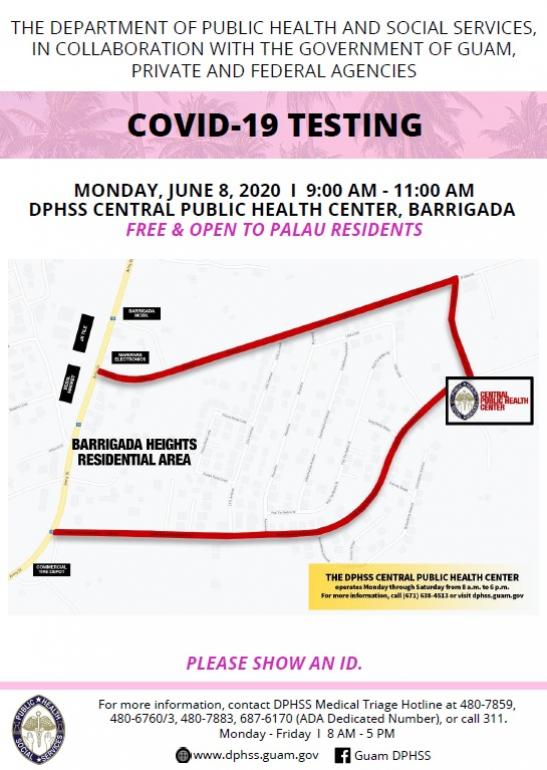

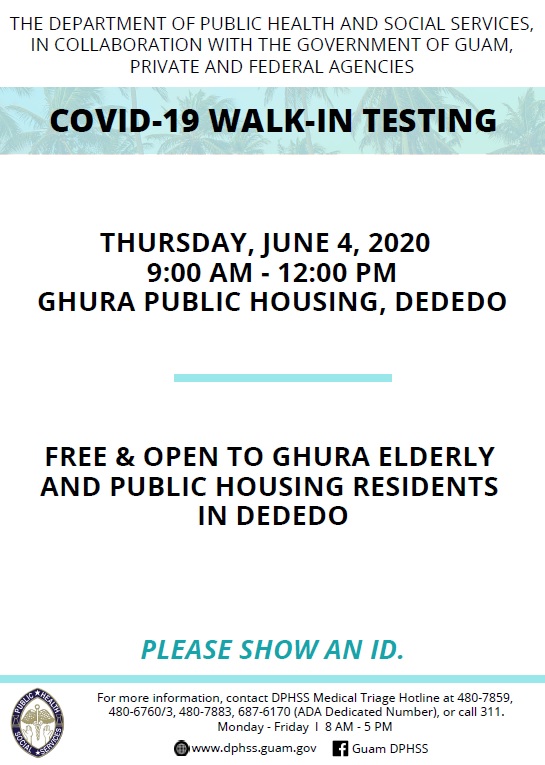

Posted 6/4/2020

Posted 6/4/2020

Posted 6/4/2020

Posted 6/4/2020

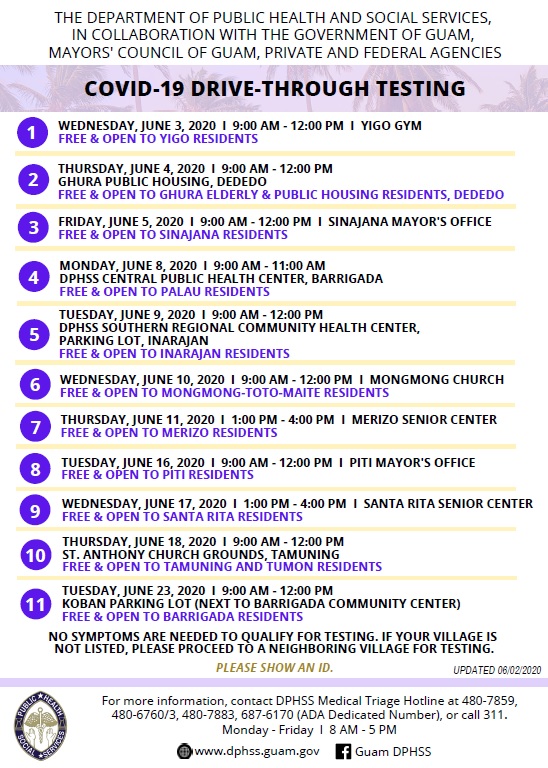

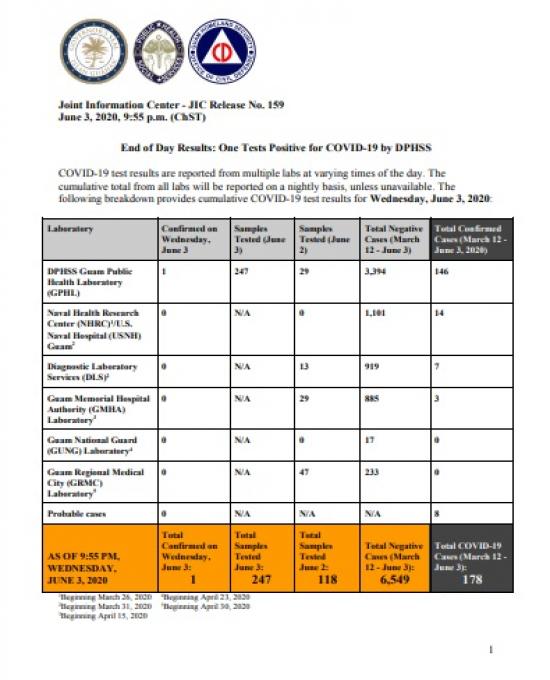

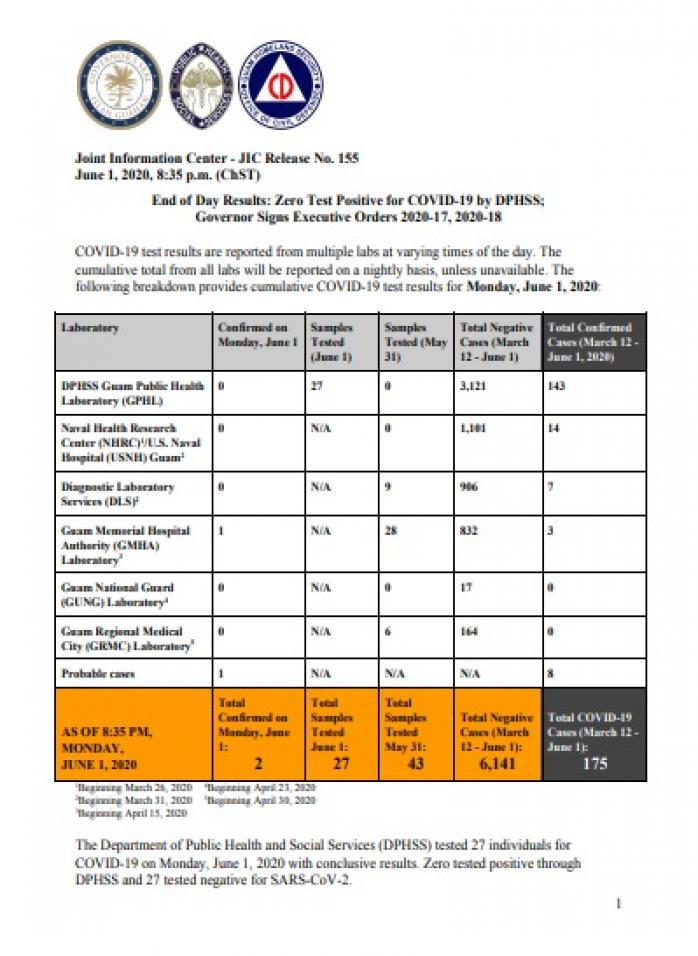

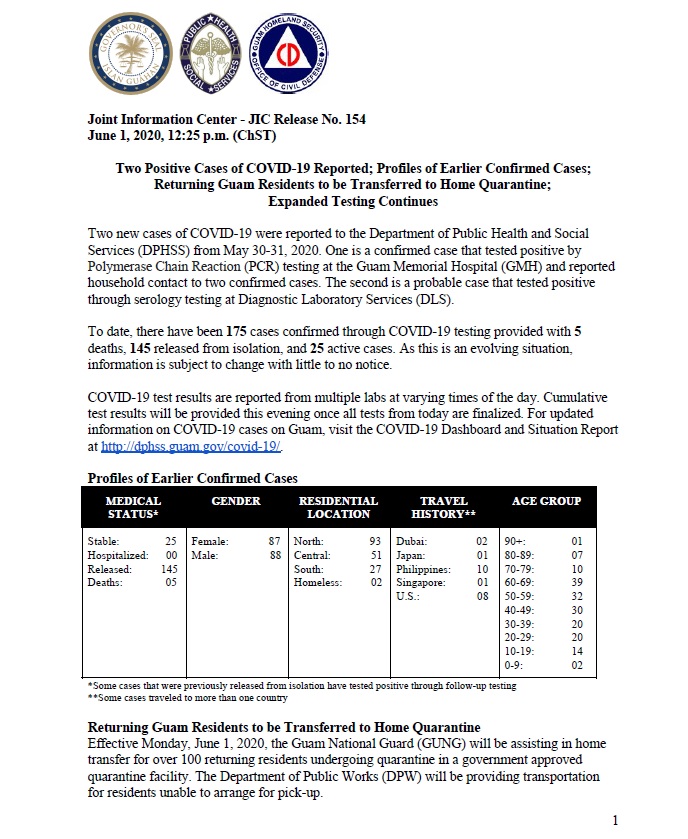

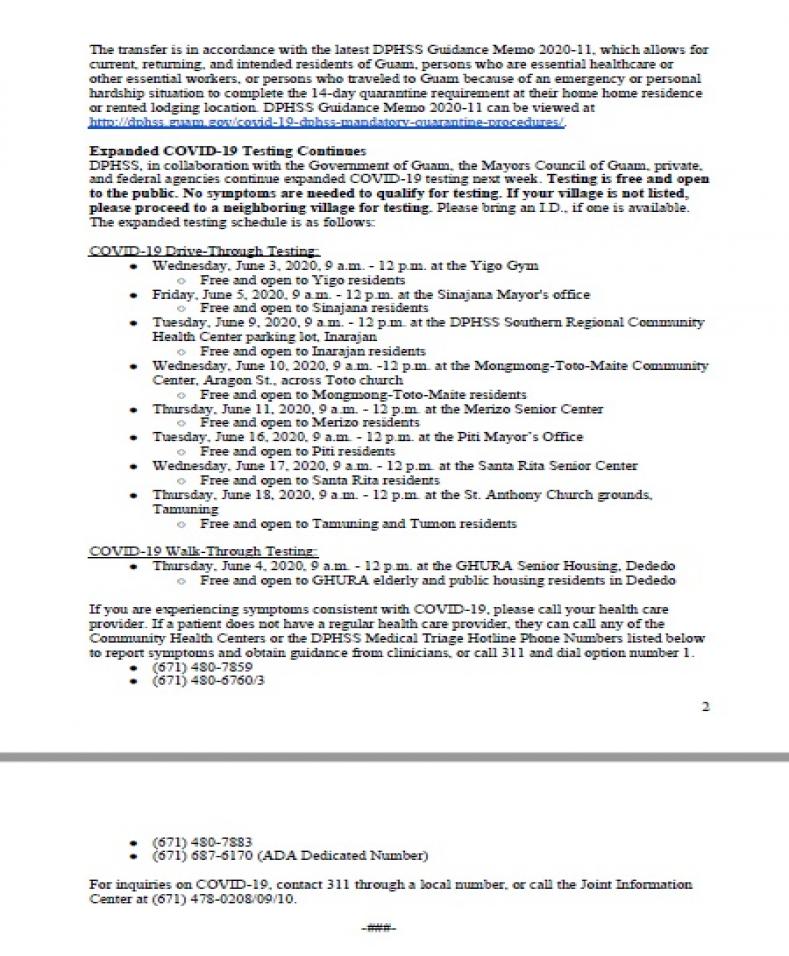

Posted 6/1/2020

Posted 6/1/2020

Posted 6/1/2020

Posted 6/1/2020

Posted 6/1/2020

Posted 6/1/2020

Posted 6/1/2020

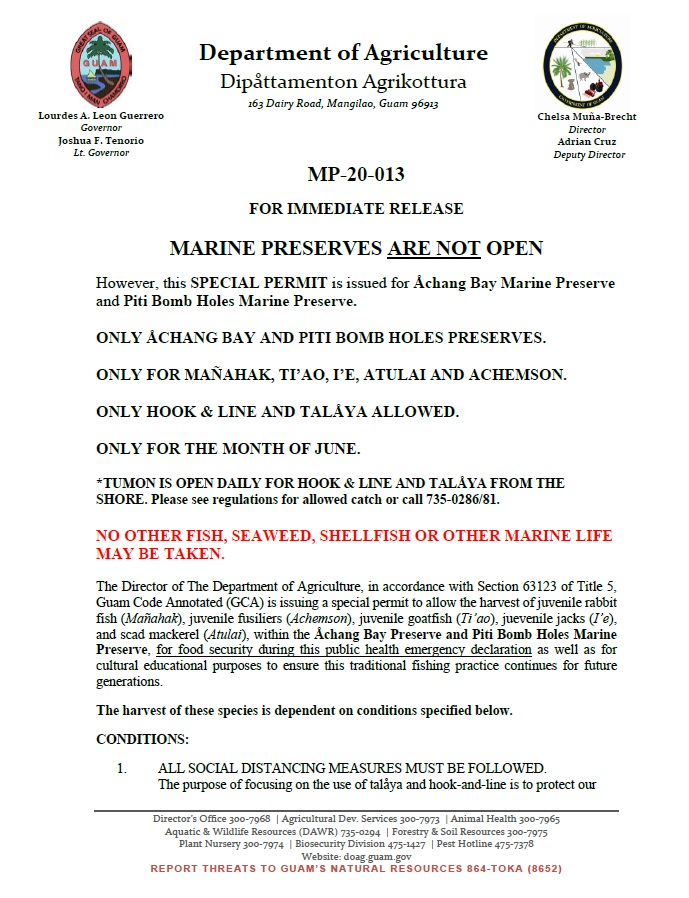

Posted: 5/22/2020

Posted: 05/18/2020

Posted: 05/18/2020

Posted 05/14/2020

Posted 05/13/2020

Posted 05/13/2020

Posted 05/13/2020

Posted 05/11/2020

Posted: 05/11/2020

Posted: 05/08/2020

Posted 5/08/2020

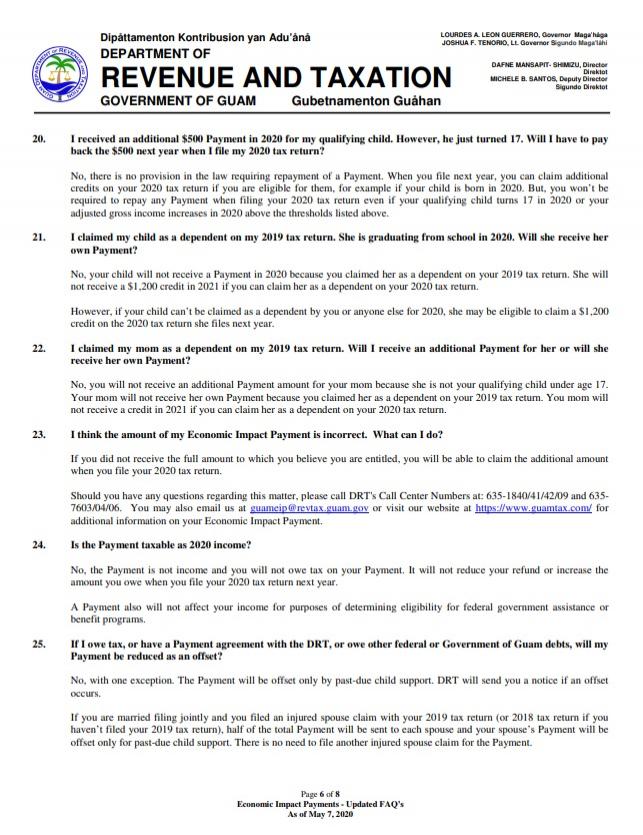

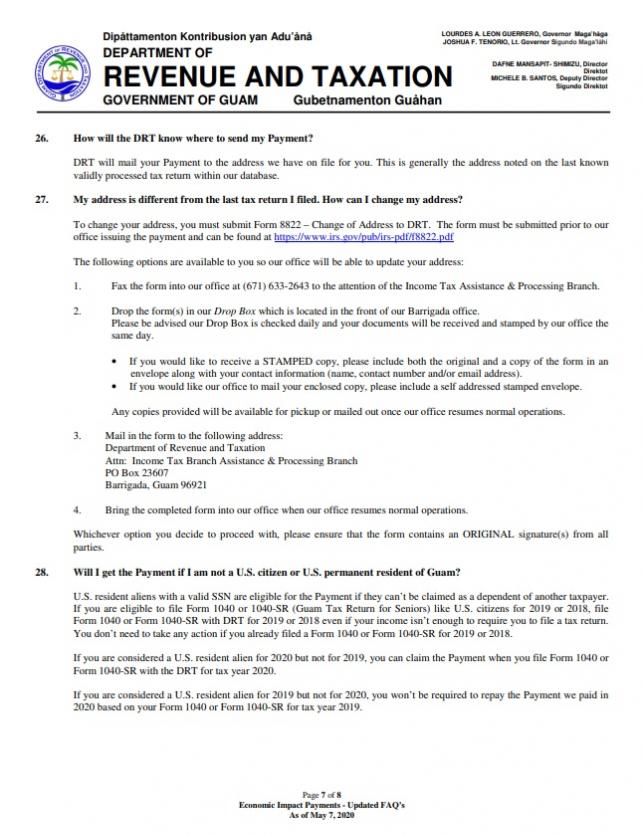

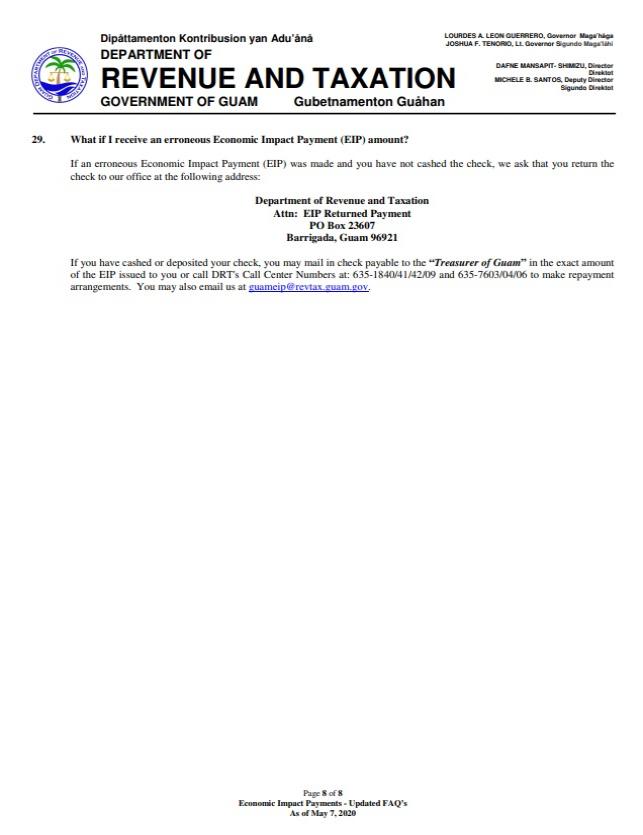

Posted: 5/08/2020 DRT EIP Questions and Answers

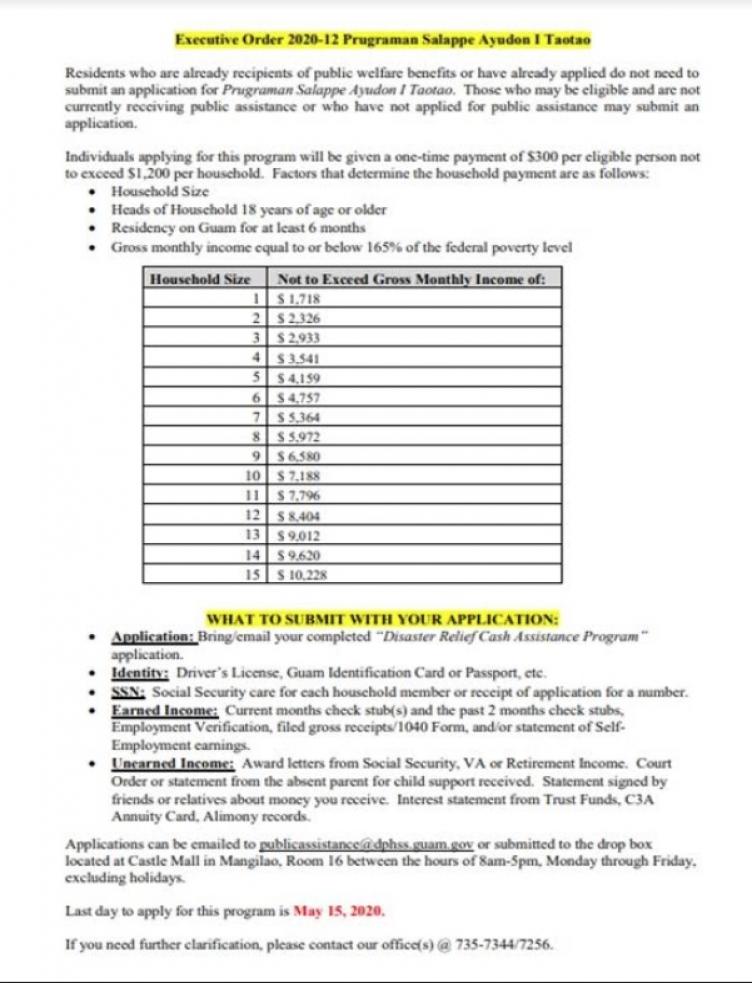

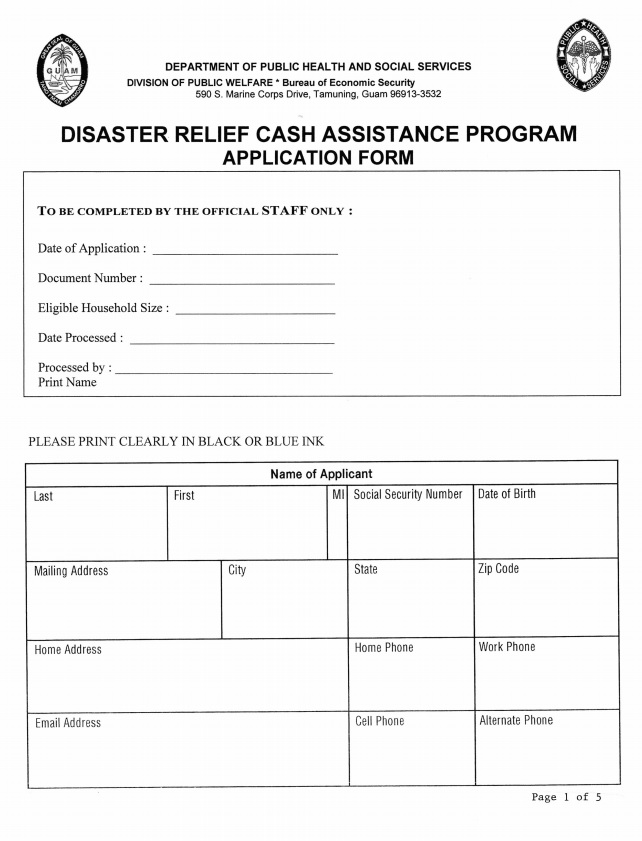

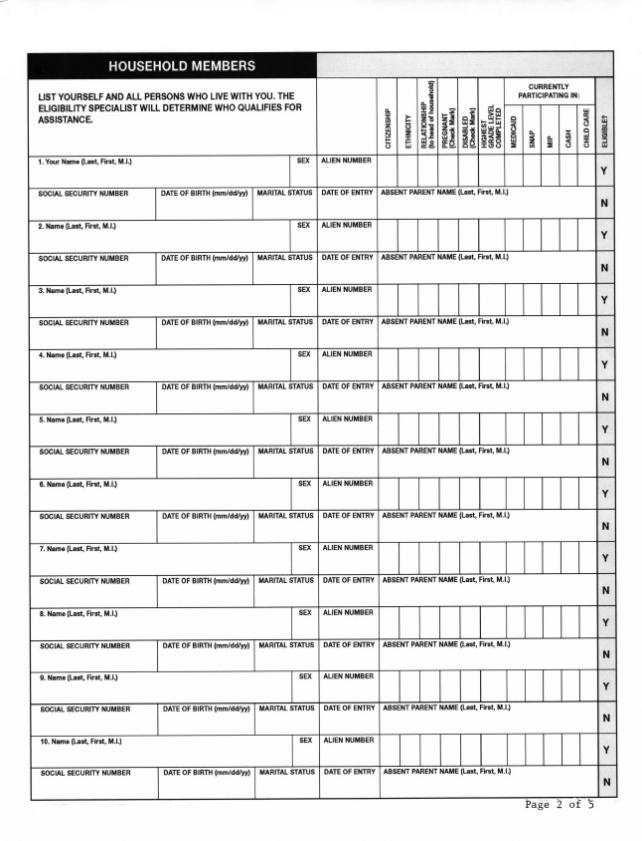

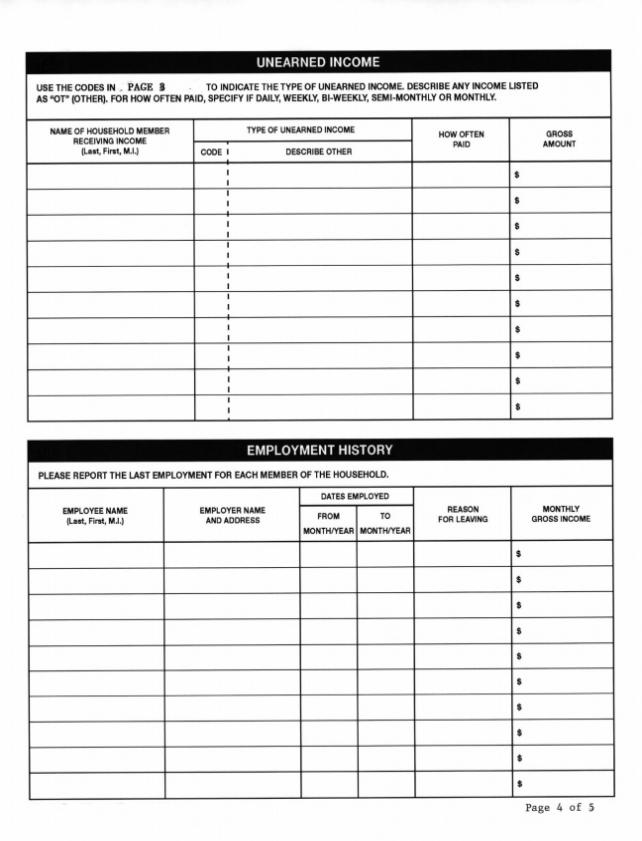

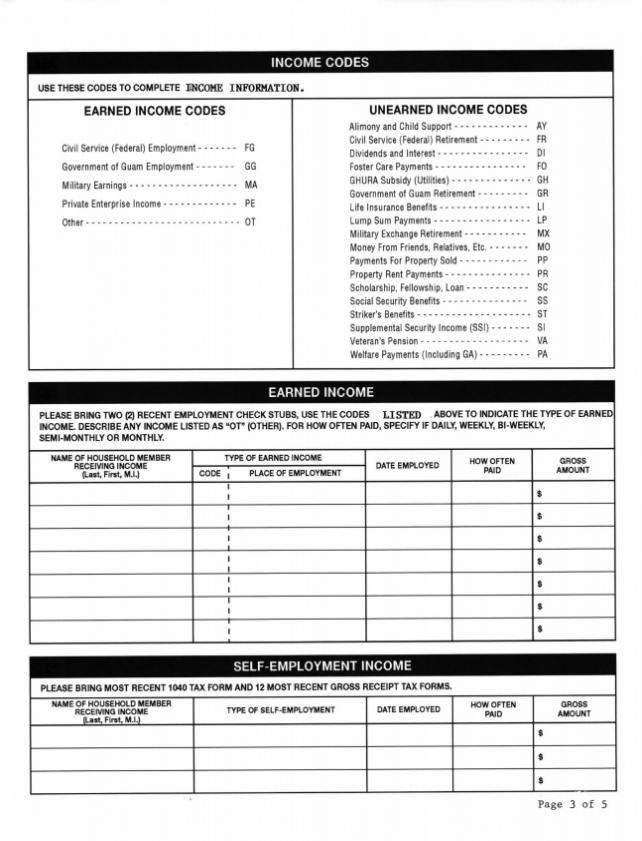

Posted: 05/11/2020 ' NEW CHECKLIST FOR THE DISASTER RELIEF CASH ASSISTANCE PROGRAM APPLICATION FORM"

Posted: 5/08/2020

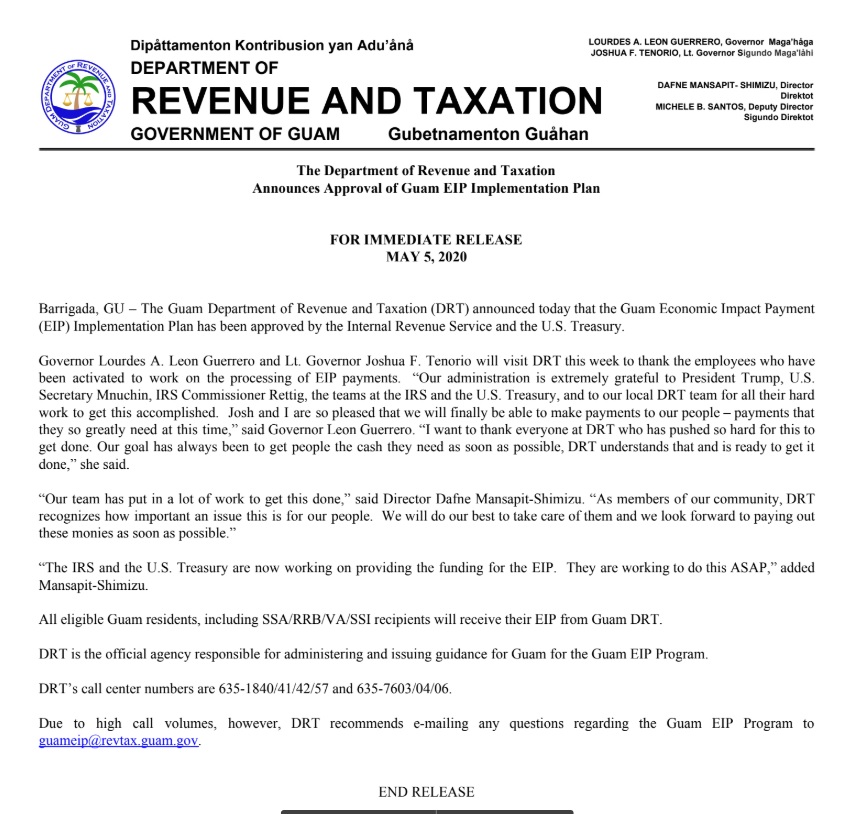

Update Posted: 5/05/2020

Update Posted on 5/05/2020

Update Posted 5/05/2020

As of April 21, 2020:

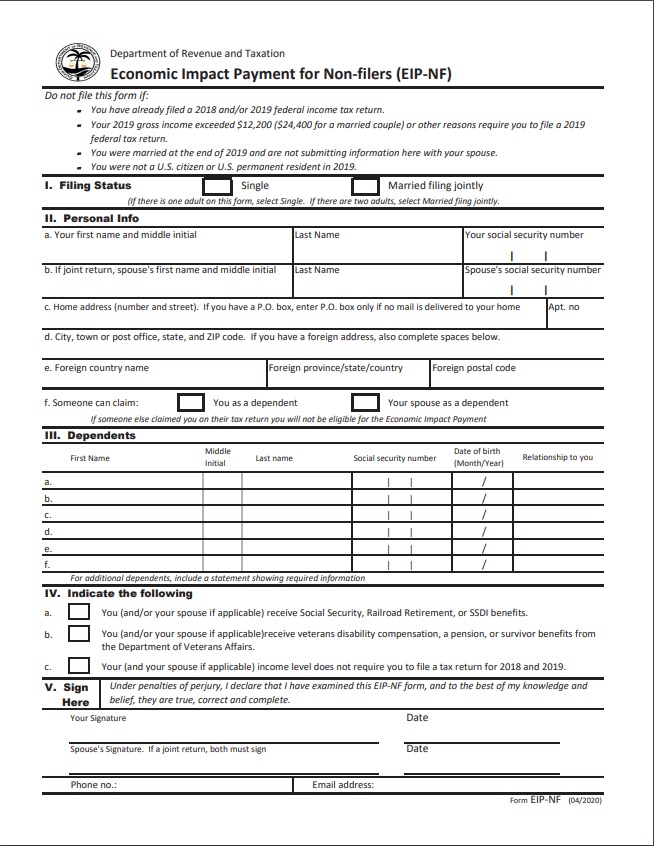

The form can be downloaded online at the Department of Revenue and Taxation website at https://www.guamtax.com/forms/index.html

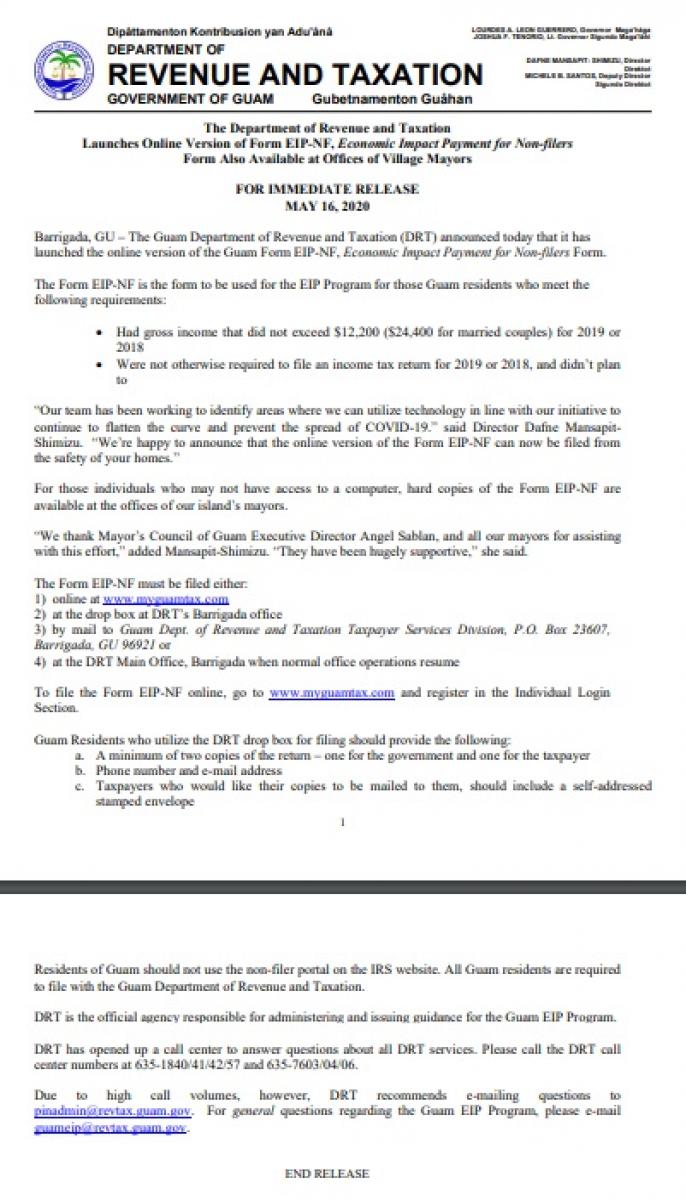

The Guam Deparment of Revenue and Taxation has released its Form EIP-NF (Economic Impact Payment for Non-filers) which is to be used for the IEP program for those Guam residents who meet the following requirements:

- Had gross income that did not exceed $12,000 ($24,400 for married couples) for Year 2019 and 2018

- Were not otherwise required to file a federal income tax return for 2019 and 2018, and did not plan to

Guam Residents who utilize the DRT drop box for filing should provide the following:

a) A minimum of two copies of the return - one for the government and one for the taxpayer

b) Phone number and e-mail address

c) Taxpayers who would like their copies to be mailed to them, should include a self-addressed stamped envelope

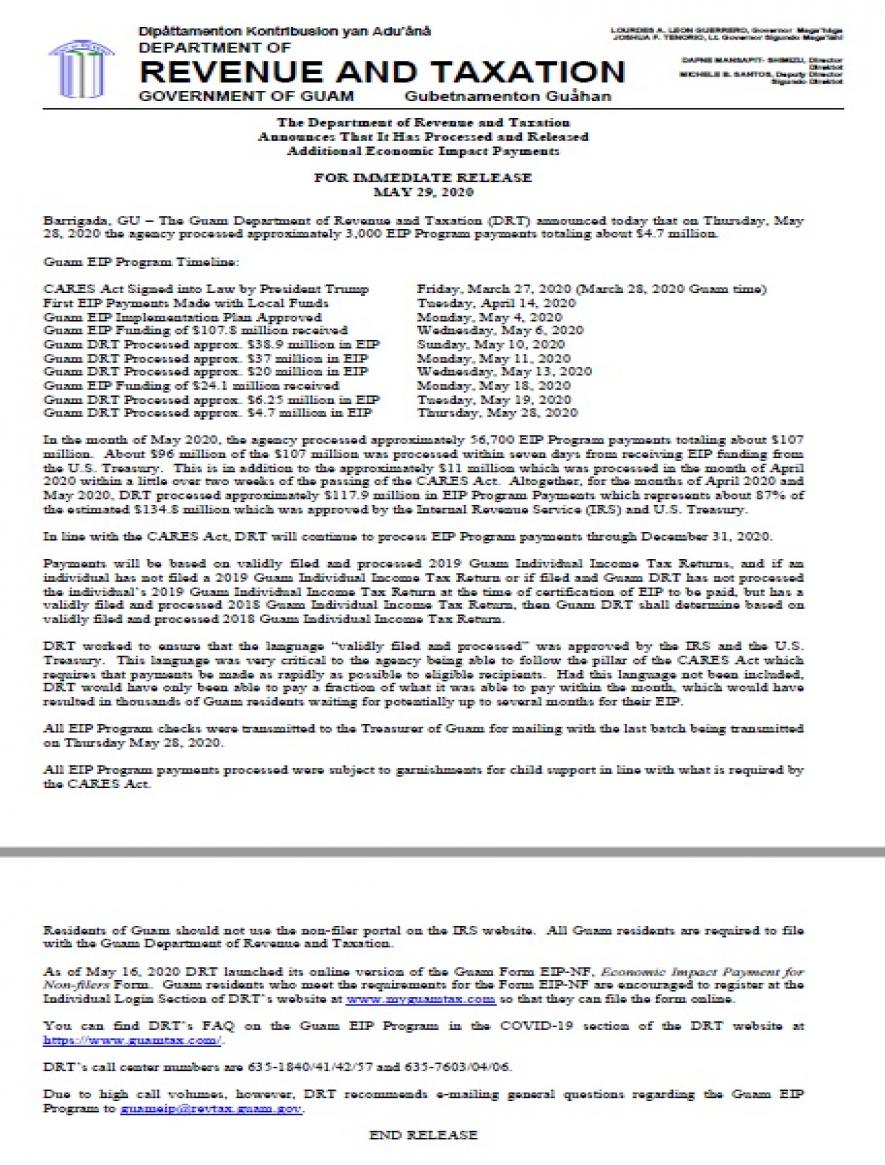

Residents of Guam should not use the non-filer portal on the IRS website. All Guam residents are required to file with the Guam Dept. of Revenue and Taxation.

For any questions regarding the EIP Program, send e-mails to [email protected] .

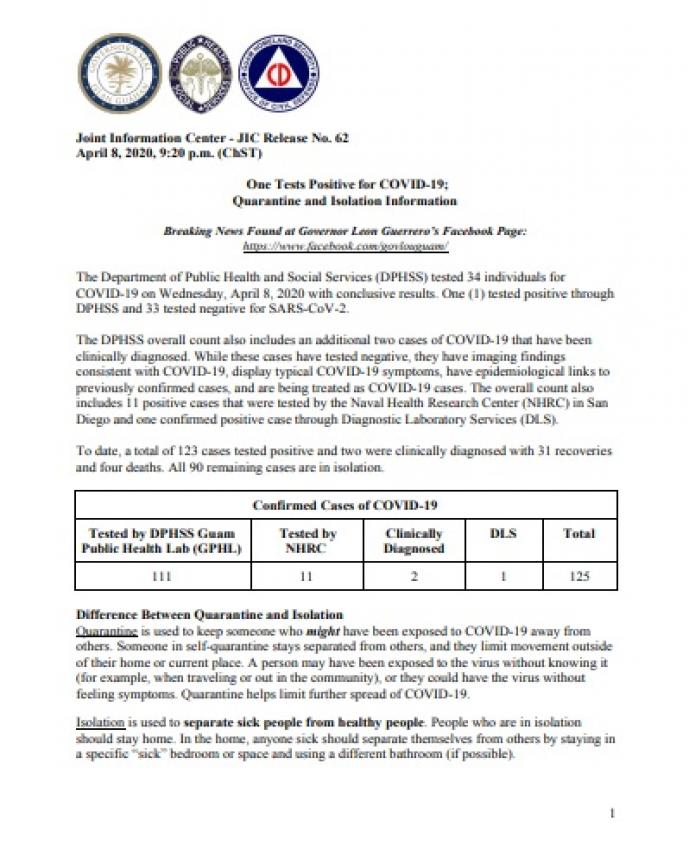

As of April 8, 2020